Events In The History Of Aave Rates

Exploring major events in the history of Aave interest rates including the USDC depeg, ETH PoW fork and sUSDe looping.

Lending markets experience spikes in demand when the environment becomes risky or offers opportunities for profit. This article examines three events that influenced Aave markets.

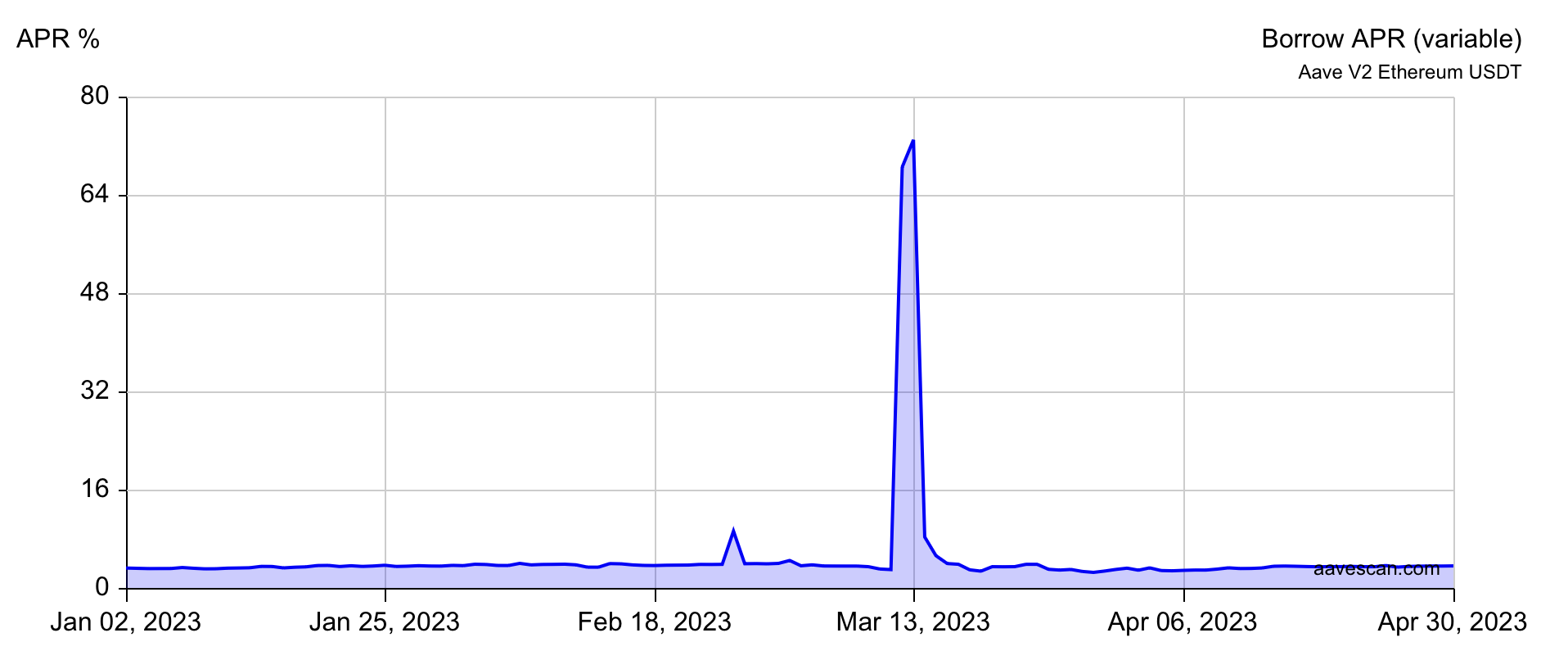

The USDC depeg in March 2023

On March 11, 2023, USDC lost its dollar peg after Circle revealed $3.3 billion of reserves were stuck in Silicon Valley Bank. Investors rushed to USDT, an alternative stablecoin, triggering a surge in demand across decentralised exchanges and DeFi lending markets. On Aave this demand pushed USDT borrow rates above 60% APR as investors sought to obtain USDT to sell at a premium across decentralised exchanges and/or to purchase USDC at a discount. Rates normalized once USDC regained its peg four days later.

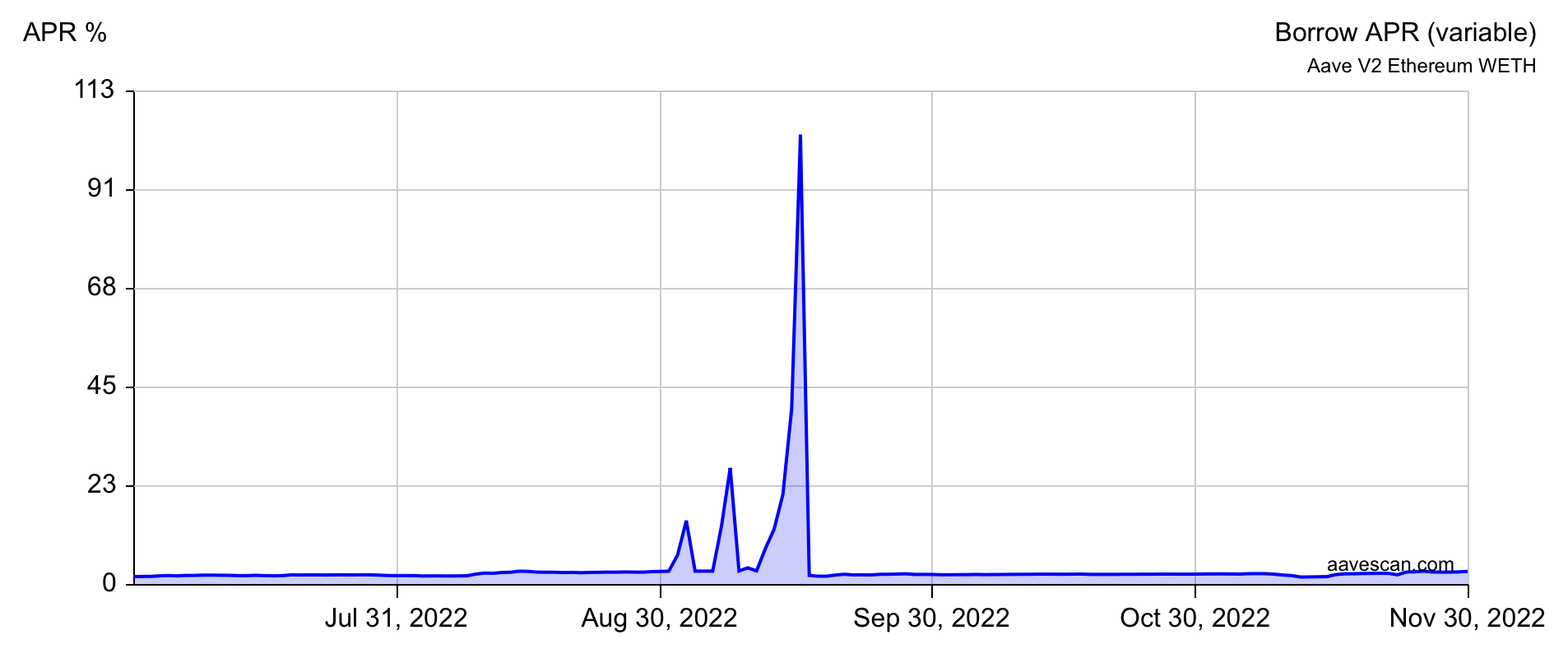

The Ethereum PoW fork in September 2022

During the Merge, Ethereum’s transition to Proof of Stake on September 15, 2022, traders positioned for the anticipated Ethereum PoW (ETHW) airdrop. To qualify, users needed to hold ETH in their wallets at the time of the fork. This led to a sharp increase in demand for ETH onchain, driving Aave’s ETH borrow rates above 90% APR as users borrowed ETH to maximize airdrop exposure. During this period, funding rates across perp venues went negative as traders hedged ETH exposure. Rates quickly returned to normal levels after the merge was completed and the airdrop snapshot passed.

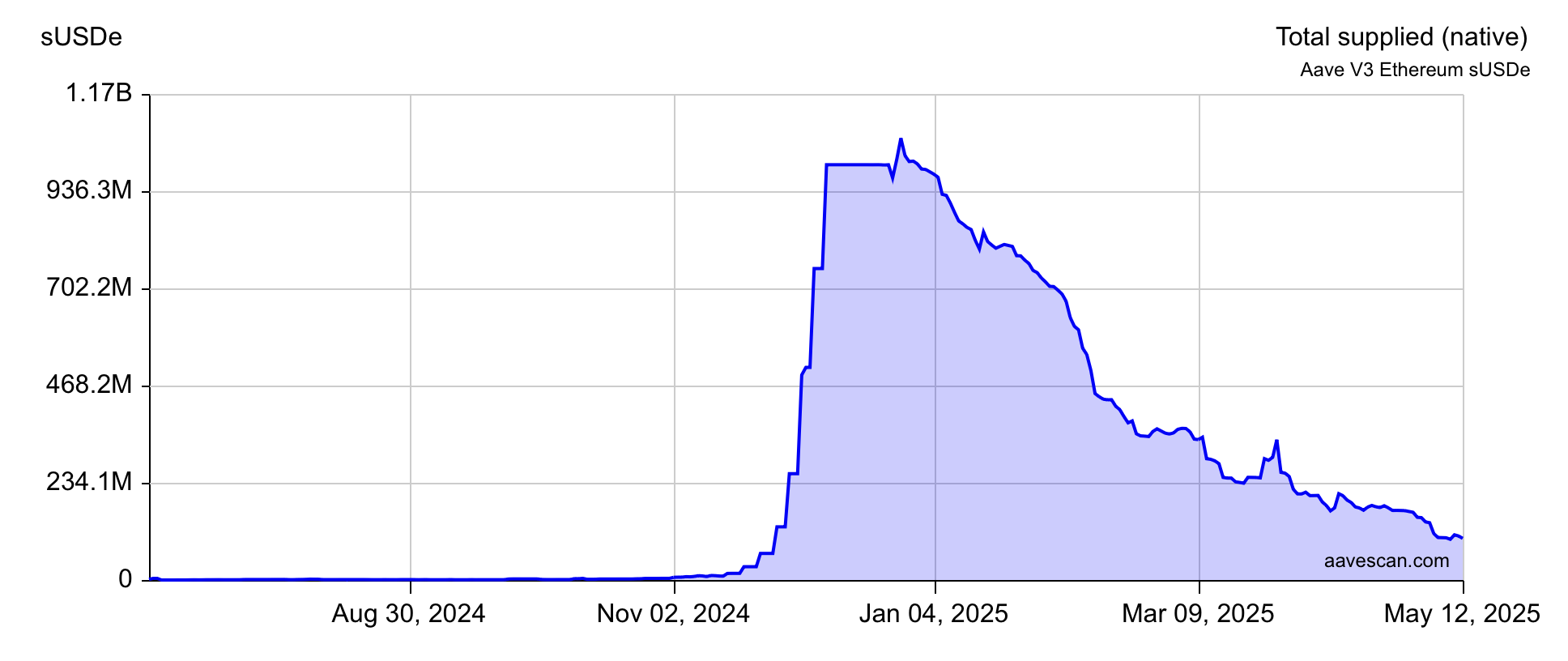

The sUSDe leverage loop in 2024

In 2024, crypto markets saw sustained positive funding rates, creating an ideal environment for Ethena’s sUSDe to generate high yields via its delta-neutral basis trade. As sUSDe yield grew popular, investors piled into sUSDe and looped it on Aave: depositing sUSDe, borrowing stablecoins/ETH, swapping back to sUSDe and repeating to maximize exposure to the yield. This drove rapid growth in sUSDe supply and Aave deposits. The loop began to unwind when funding rates declined, compressing yields and reducing the profitability of the trade, leading to deleveraging across markets.

Aavescan

Explore all the data featured in this article on Aavescan.